If you are new to importing goods into the United States, this article will give you everything from answering the question “What is an HTS code?” to providing key import classification strategies.

Let’s start at the beginning: when importing into the U.S., you will have to know the official HTS Code for your imported commodity. The Harmonized Tariff Schedule (also known as an HTS or HTSUS code) is a system used to classify goods imported into the U.S. and is based on the global HS Code system used to classify trade goods worldwide.

However, accurately classifying products is a challenge for many organizations and navigating the classification terms used by government agencies and the logistics industry can be daunting.

Below, we present a basic primer to product classification as well as important strategies for you to consider when importing your goods.

What is the Harmonized System?

HS codes, tariff codes, tariff classifications, HS classifications and HTS codes all refer to the World Customs Organization’s (WCO) published nomenclature for the classification of goods that are traded across borders. This almost universally adopted system allows Customs authorities to identify traded products in a standardized way, without having to study product descriptions of every item that a trader is bringing across a border.

The current nomenclature consists of 21 Sections, spanning 99 Chapters.

The HS Code List

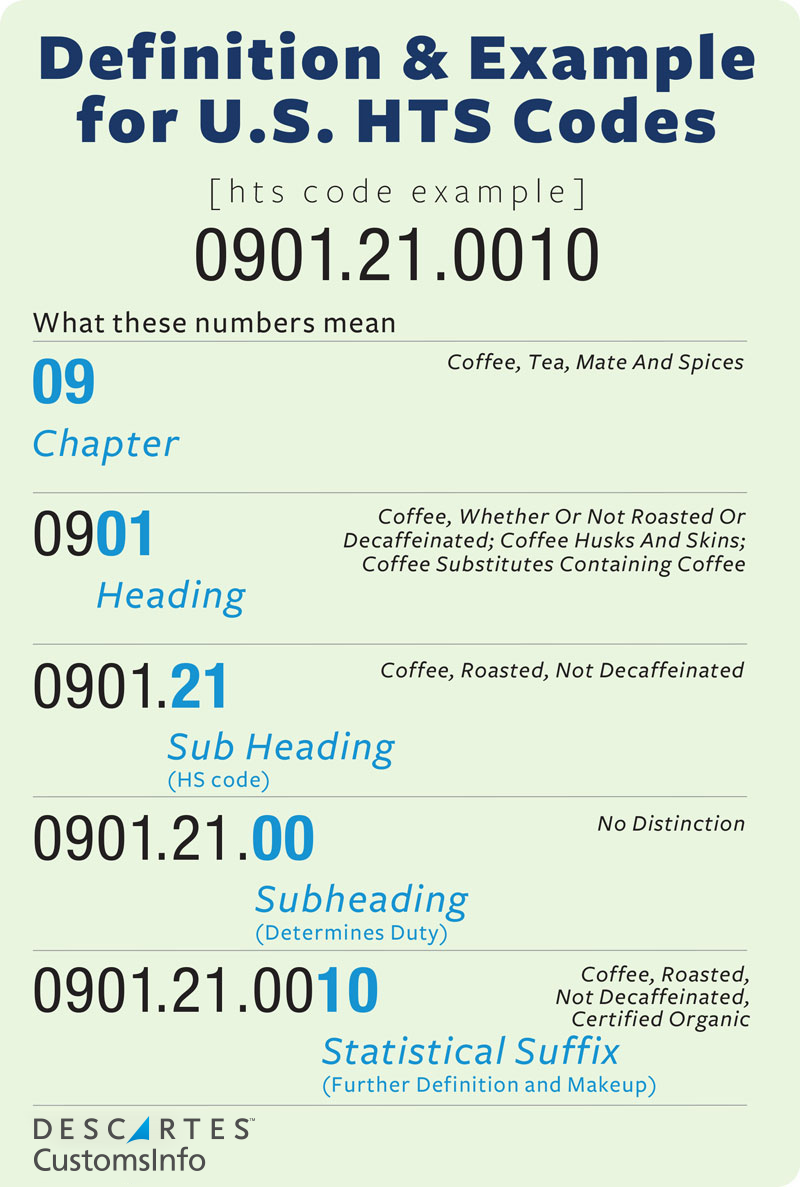

Within the Harmonized System, the first two sets of digits categorize the product, the second two define this classification further, and the final set specifies the product in more detail.

The first two sets of numbers are known as the chapter. This is the broadest term of classification for a product and there are 99 of these chapters within the harmonized system. For example, Chapter 9 of the harmonized system categorizes Coffee, Tea, Maté, and Spices.

The next set of numbers are known as the heading. In our example, coffee would be differentiated from tea in the heading.

The final set of numbers in the harmonized system are known as the sub heading.

What is the difference between the Harmonized System and the Harmonized Tariff Schedule?

The Harmonized Tariff Schedule of the United States (HTS) was developed and implemented in 1989 and is comprised of a hierarchal structure for describing all trade goods. It is very similar and structurally based on the Harmonized System and utilizes the same 4- and 6- digit product categories.

However, the HTS then includes two additional sets of numbers. The first, called the subheading, determines the duty rate of a particular item and the last, the statistical suffix, further refines the product classification.

The Importance of Product Classification

U.S. Customs and Border Protection (CBP) as well as other customs agencies apply customs and import duties, anti-dumping and countervailing duties, alongside other taxes and fees based upon the HS and HTS code presented in a product’s import declaration.

Having an incorrect product classification can become a serious issue and represents a failure on the part of the importer to perform their own proper due diligence. Improper HTS code classification can result in fines and penalties imposed by CBP and other organizations.

Reduce Duty Spend

Beyond proper due diligence, understanding product classification can improve your bottom line. Through understanding your product and its classification, you could find out that you’ve been using the wrong HTS code, leading to you paying higher-than-required duties and taxes.

Additionally, closely examining the HTS can reveal opportunities for exceptions and reducing duty spend through a product known as tariff-engineering. (More to come on that in a later post)

How the Pro’s Do It

Determining a HS code can often be more of an art than a science and can take years of experience to master.

When attempting to assign a HS code to a product, brokers and compliance specialists utilize the first 4 out of 6 General Rules of Interpretation (GRI) one-after-another until the product is classified and the process stops.

To properly utilize the GRIs, traders must consult the harmonized tariff schedule and consider Chapter, Heading and Sub-Heading notes that may include definitions, exclusions or inclusions. The classifier must also be familiar with the language of the tariff book and understand what commas or semi-colons mean when these appear in descriptions. It is almost impossible to build competency in the area of tariff classification without some level of focused practice and study. The rules are not intuitive and without making an attempt to understand how they were meant to be used, traders will not be able to self-classify parts accurately.

General Rules of Interpretation

General Rules of Interpretation 1

The descriptions in Section and Chapter titles within the HTS are for guidance only. Proper classification requires importers to read the Section and Chapter notes in order to know what kinds of products may be excluded or included in the Chapter. These notes can sometimes be lengthy, but it is impossible to intuitively know which products are covered in a Section or Chapter and hence it is important not to skip this step no matter how daunting these notes can be.

The descriptions included with Headings and Sub-Headings are to be used when determining a HS code, assuming that the Section and Chapter notes do not exclude the product type.

General Rules of Interpretation 2

GRI 2a specifies that incomplete, unassembled or unfinished products that already possess the essential character of the final product, should be classified as that final product.

GRI 2b states that mixtures or materials like chemical mixtures should be classified using GRI 3.

General Rules of Interpretation 3

GRI 3a states that if for any reason, if at first glance multiple Headings seem to apply to a product, the most specific Heading should be chosen.

GRI 3b states that mixtures, sets and composite products should be classified according to the product’s essential character. The definition of essential character is not properly formulated in the explanatory notes of WCO’s tariffs. Typical methods of determining essential character are to look at form, function, component cost, weight or size of parts. However, this topic is often open to fierce debate.

GRI 3c is used when faced with a composite product or mixture where no single component gives the material it’s essential character. When this is the case, the item must be classified under the Heading that occurs last in the order of the nomenclature.

General Rules of Interpretation 4

If the item cannot be classified in the tariff due to its extremely unique nature, GRI 4 requires the importer to classify the product by using the classification of a product similar to it.

General Rules of Interpretation 5

GRI 5a states that containers and packaging materials are classified under the same HS code as the finished good they contain, as long as the container does not give the product its essential character.

GRI 5b requires packaging materials intended for reuse to be classified separately.

General Rules of Interpretation 6

GRI 6 is probably the most important rule of all the GRIs, yet it is not well understood even by very experienced Customs brokers. This rule simply states that the Headings and Sub-Headings in the tariff should be compared at the same “dash” level, taking into account the legal notes attached if there are any. This rule truly deserves its own write up, but here are some pointers below.

- When attempting to classify a product, the trader must first decide the Chapter.

- Within that Chapter, the trader must decide the Heading that he/she wants to use.

- Within the Heading, the trader must decide the Sub-Heading that he/she wants to use.

Top Strategies for Product Classification

1. Understand HS & HTS Codes

We’ve already covered the Harmonized System and the Harmonized Tariff System in depth.

- Chapter

- Heading

- Subheading

- Extra Digits

2. Know Your Product

By this point, it should be obvious that you need to fully understand your product in order to properly classify them.

By properly understanding your product, you can avoid classification errors and save significantly on your duty spend

3. Informal Classifications

Every item entering the U.S. has been assigned a tariff classification number, which is the basis for all decisions relating to that item. Here are some ways to identify the tariff classification number of your product:

- Discuss the product with a commodity specialist.

- Access the HTSUS online.

- Contact the port director where your merchandise will be entered.

The information from any of these sources is informal and not binding. This is different from an informal vs. formal entry. An informal classification may be subject to increased review from CBP and needs to be defensible by the importer.

Additionally, a method that can be used to support your classifications (and defend them!) is to refer to previous binding decisions from CBP. These decisions, requested by other importers and published by CBP, can assist you when importing similar products.

4. Binding Decisions / Classification Requests

To support your classifications, there are two methods to achieve an official and defensible classification of your goods: Binding decisions and classification requests. The binding and ruling program from CBP allows importers to acquire official determinations on the treatment of goods entering the United States. This can include, but isn’t limited to, classifications, valuations, and country of origin. The requirements for these requests vary based upon the information needed, we’ve included two of the more common scenarios below:

1. Requesting a General Binding Decision

- A binding ruling enables you to get binding pre-entry classification decisions prior to importing a product and filing entries with CBP. A binding ruling also allows you to get binding guidance about other CBP regulations pertaining to marking the country of origin.

- Under the Electronic Ruling program, the importer may submit an electronic request for a binding ruling by accessing the eRulings Template. The template lets you electronically file a binding ruling request with the National Commodity Specialist Division (NCSD) of Regulations and Rulings.

- The following information is required in ruling requests:

- The names, addresses, and other identifying information of all interested parties

- The name(s) of the port(s) at which the merchandise will be entered

- A description of the transaction (for example, “A prospective importation of paper clips from South Korea”)

- A statement that there are, to your knowledge, no issues on the commodity pending before CBP or any court

- A statement on whether you’ve previously sought classification advice from a CBP officer, and if so, who responded and what the advice was

2. Requesting a Classification

- Similar to requests for a binding decision, you have the option to request a classification from CBP. To do so, you need the following information:

- A complete description of the goods; send samples (if practical), sketches, diagrams, or other illustrative materials that will be useful in supplementing the written description

- Cost breakdowns of component materials and their respective quantities shown in percentages if possible

- A description of the principal use of the goods (as a class or kind of merchandise) in the U.S.

- Information about commercial, scientific, or common designations, as may be applicable

- Any other information that may be pertinent or required for the purpose of tariff classification

5. Using Technology

Effective and timely global tariff code lookup and regulatory research are a challenge for many businesses that move goods across borders. HS codes, duties and tax rates change frequently, as do government regulations and policies relating to classification, valuation, and special trade programs and free trade agreements.

Improve the Accuracy of your HTS Code Determination, While Reducing Time Spent on Classification

Descartes CustomsInfo Reference has an up-to-date database of more than 6 million regulatory sources covering 160+ countries.

Its advanced global tariff code lookup and HS and HTS code search capabilities are accessed from a single-screen interface, helping import compliance professionals, attorneys, consultants and others make better classification decisions significantly more efficiently, optimize duty spend, as well as support classification determinations for audit purposes.